How to Save for an Emergency Fund

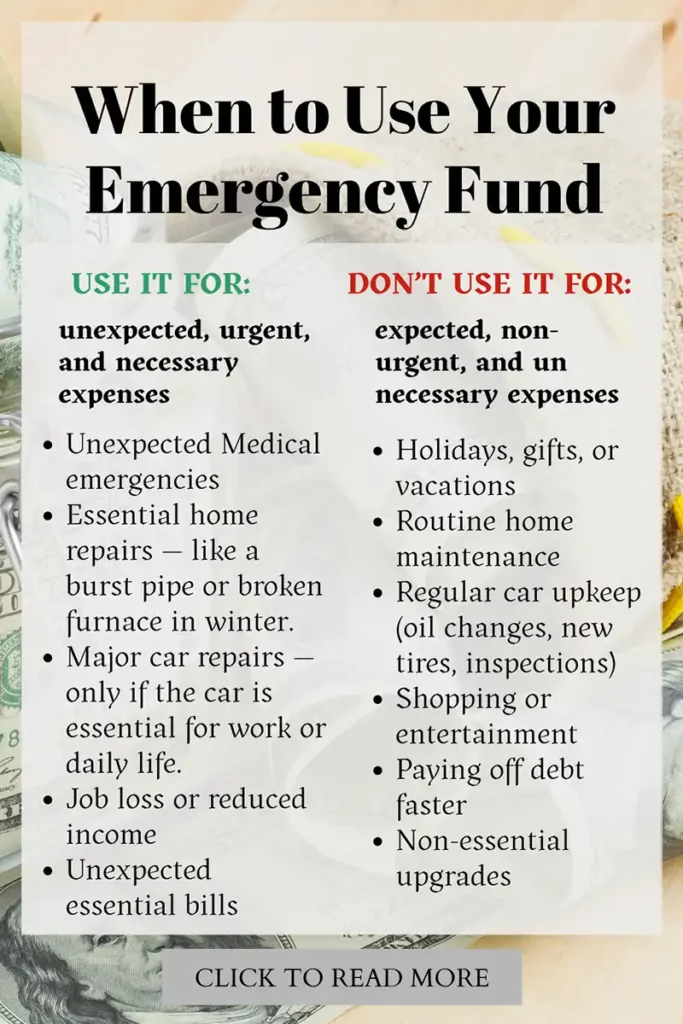

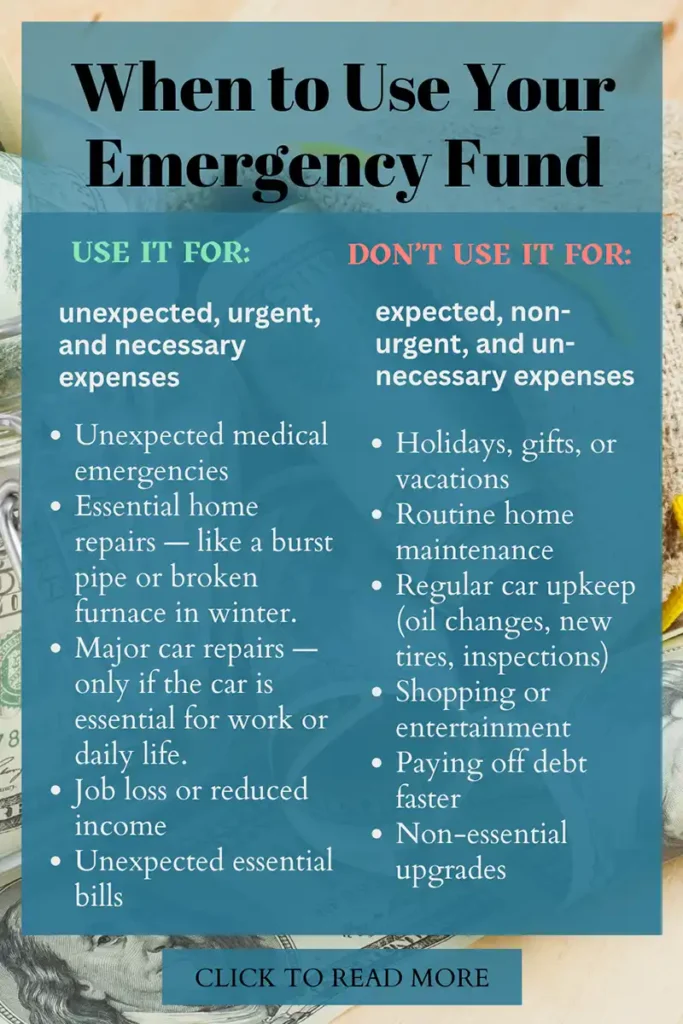

Life is full of surprises—and not always the fun kind. Whether it’s a sudden car repair, a medical bill, or an unexpected job loss, having an emergency fund is like giving yourself a safety net. An emergency fund is also essential for any homeowner. However, when money is already tight, the idea of saving up thousands can seem impossible.

However, you don’t need to do it all at once. With the right plan and a few creative strategies, you can build an emergency fund faster than you think.

1. How Much You Really Need

An emergency fund doesn’t have to be intimidating. Start with a goal that feels manageable. Many experts suggest aiming for $1,000 as a starter fund—just enough to cover common emergencies. Once you reach that, you can work toward 3–6 months of living expenses.

Breaking the goal into steps makes it feel achievable and keeps you motivated as you check off milestones.

2. Track Your Spending

You can’t save what you can’t see. For one week, write down every expense you make, including the small ones that often go unnoticed. Then ask: What can I cut or pause just for a little while? Do you need help tracking your expenses? Try our simple Expense Tracker.

Some quick wins:

- Cancel or downgrade unused subscriptions.

- Cook at home instead of takeout.

- Pause big purchases until after you’ve hit your goal.

Even small trims of $20–$50 a week add up quickly when redirected to your savings.

If you need help managing your recurring or irregular expenses and subscriptions, we have created a Bill Calendar that tracks them and displays them in a calendar, so you can see how much is due each day of the month.

3. Automate Your Savings

Make saving easier by taking willpower out of the equation. Set up an automatic transfer to a separate savings account every payday—before you even see the money in your checking account.

One of the easiest and most effective ways to build an emergency fund quickly is to automate your savings. When you rely on willpower alone, it’s all too easy to forget, get busy, or convince yourself to skip saving “just this once.” But when you set up an automatic transfer to a separate savings account, the money moves before you even get the chance to spend it.

Think of it as paying yourself first—it’s like putting your financial security at the top of the list instead of treating it as an afterthought. The best part is you don’t need to start big. Even $10, $20, or $50 a week can add up to hundreds over the course of a year, and once you see your account balance grow, it becomes much easier to stay motivated.

Contact your bank and inquire about the setup options they offer to allow you to set aside a specific amount with each paycheck. For even faster results, direct deposit a small percentage of your paycheck into savings automatically.

Over time, this method helps avoid temptation and reach your emergency fund goal faster than you thought possible.

4. Put Extra Money Towards Your Emergency Fund

Did you get a tax refund, birthday money, or overtime pay? Instead of spending it, drop it straight into your emergency fund. These “found” dollars can give your savings a big jumpstart.

Another effective way to quickly grow your emergency fund is to put windfalls and extra income to work. A windfall is any unexpected money that comes your way—tax refunds, bonuses, birthday cash, rebates, or even a larger-than-expected paycheck.

Because this money isn’t part of your regular budget, you won’t miss it if you set it aside right away. Too often, we think of these “surprise dollars” as spending money, but redirecting them to your emergency fund can give your savings a significant boost with very little effort. Imagine adding your tax refund straight to your emergency account—you could cover a month’s rent or a car repair in one go.

These lump sums serve as shortcuts toward your goal, helping you build financial security much faster than relying solely on small, steady contributions.

In addition to windfalls, extra income from side hustles can also make a huge difference. Selling items you no longer use, babysitting, freelancing, or picking up a few extra hours at work are all great options. Even better, why don’t you think about how you could turn your hobby or passion into a business? Nowadays, there are numerous platforms available for selling your items, and it’s easier than ever to create the necessary text and images. Even small amounts—like $20 here or $50 there—quickly add up when they’re consistently funneled into savings.

To stay motivated, track how much “bonus money” you’ve saved over time and celebrate each milestone. Viewing these extras as opportunities instead of splurges changes your mindset and accelerates your progress. The more you commit these unexpected funds toward your emergency savings, the sooner you’ll build a cushion that provides real peace of mind.

5. Challenge Yourself

Sometimes a little creativity makes saving fun. Try:

- No-spend weekends. A no-spend weekend might sound intimidating, but it can actually be a lot of fun. Instead of shopping or eating out, consider exploring free activities—such as hiking, visiting the library, hosting a potluck, or enjoying a family game night. Not only do you save money, but you also create meaningful memories. Even skipping just two days of spending can free up $50–$100 to move straight into your emergency fund. Try treating it like a mini challenge—how creative can you get while spending nothing?

- Cash-only challenges. Using cash for all your purchases for a week (or even just a few days) is a great way to become more intentional with your spending. When you hand over physical bills, you feel the “loss” of money more strongly than when swiping a card. Set a budgeted amount, carry it in cash, and when it’s gone, it’s gone! At the end of the challenge, take whatever you didn’t spend and add it to your emergency fund.

- Round-up accounts or apps: Round-up apps help you save by rounding up your purchase to the nearest dollar and saving the difference. It doesn’t feel like much in the moment, but those small amounts add up surprisingly fast over weeks and months. The best part? You won’t even miss the change, yet you’ll see your emergency fund grow steadily in the background. If you don’t want to use or don’t have access to round-up apps, your bank can often set up a savings account that does just that. It will transfer the difference from your purchase, rounded up to the nearest dollar, into a separate savings account, which will quickly add up.

These mini-challenges add variety and keep you motivated while moving the needle on your goal.

6. Keep Your Emergency Fund Separate

One of the best tricks for fast growth is to keep your emergency fund in a separate account—preferably one you don’t touch unless it’s truly an emergency.

When it comes to building an emergency fund, one of the smartest moves you can make is keeping it completely separate from your everyday spending money. If your savings are sitting in the same account as your checking, it’s far too tempting to dip into it for things that aren’t true emergencies—because you see the money, you feel it’s there, available to spend. By giving your emergency fund its own “home,” you create a barrier that helps you pause and think before touching it. Some people even nickname their account “Do Not Touch” or “Safety Net” as a friendly reminder of its purpose.

The goal isn’t to make your money impossible to reach—you want it available for genuine emergencies—but to keep it just out of sight so you’re not tempted. Over time, watching that balance grow in its own space is motivating. It feels like you’re building a protective wall around your future, one dollar at a time, and that peace of mind is priceless.

If you get into doing this, you can even set up different accounts or places for each of the items you’d like to save for. Try out our Savings Tracker to help you keep track of all your savings and the amounts saved.

Saving an emergency fund fast is totally doable and easy to do if you follow the steps above. It’s about being intentional with your money, being consistent, and having discipline.

Remember: every dollar saved is one step closer to peace of mind. Start small, stay consistent, and before you know it, you’ll have a safety net that helps you sleep better at night.