Хорошо ли нулевое бюджетирование | Пошаговое руководство

Ever feel like your money disappears before you know where it went? Or maybe budgets never fit your life or goals. It’s easy to get discouraged, but zero-based budgeting offers a practical way to take charge. This approach gives you a fresh start each month and encourages you to be intentional with every cent. Is this budgeting method right for you?

Zero-based budgeting might sound intimidating, but it’s actually a straightforward method that puts you in the driver’s seat. With this guide, you’ll learn what it is, why it works, and how to set one up so your money starts working for you—not the other way around.

What is Zero-Based Budgeting?

Zero-based budgeting (ZBB for short) is all about putting your income to work—literally. The basic idea is this: at the start of each month, you assign every dollar you expect to receive to a specific job until there’s nothing left unaccounted for.

That doesn’t mean you spend your whole paycheck. Instead, every dollar gets a purpose for rent, groceries, debt payments, savings, or fun. Once you finish planning, your income minus expenses, savings, and debt payments equals zero—no extra money left to be spent by accident.

Unlike a traditional budget, which often uses last month’s numbers to plan for this month, ZBB makes you pause and reconsider your needs, wants, and goals every month. It’s a proactive, thoughtful way to manage your finances.

Why Try Zero-Based Budgeting?

You might wonder if ZBB is worth the extra effort. Here’s why so many people swear by it:

- Full Awareness: Since you’re assigning a job to every dollar, it’s hard to overlook those random subscriptions or frequent takeout orders. Suddenly, your spending habits become crystal clear.

- Stops Money from Slipping Away: Because every dollar is claimed up front, you’re less likely to waste money on things you don’t care about.

- Makes Goal-Setting Easier: Want to build an emergency fund? Pay down debt faster? With ZBB, you prioritize those goals and make regular progress.

- Adjusts When Life Changes: Your income and expenses probably shift a bit from month to month. With this method, you start fresh each time, so it’s easy to adapt.

- Boosts Money Confidence: Taking charge of your financial decisions—big and small—can help you feel more in control and less anxious about your future.

How to Set Up a Zero-Based Budget: Five Simple Steps

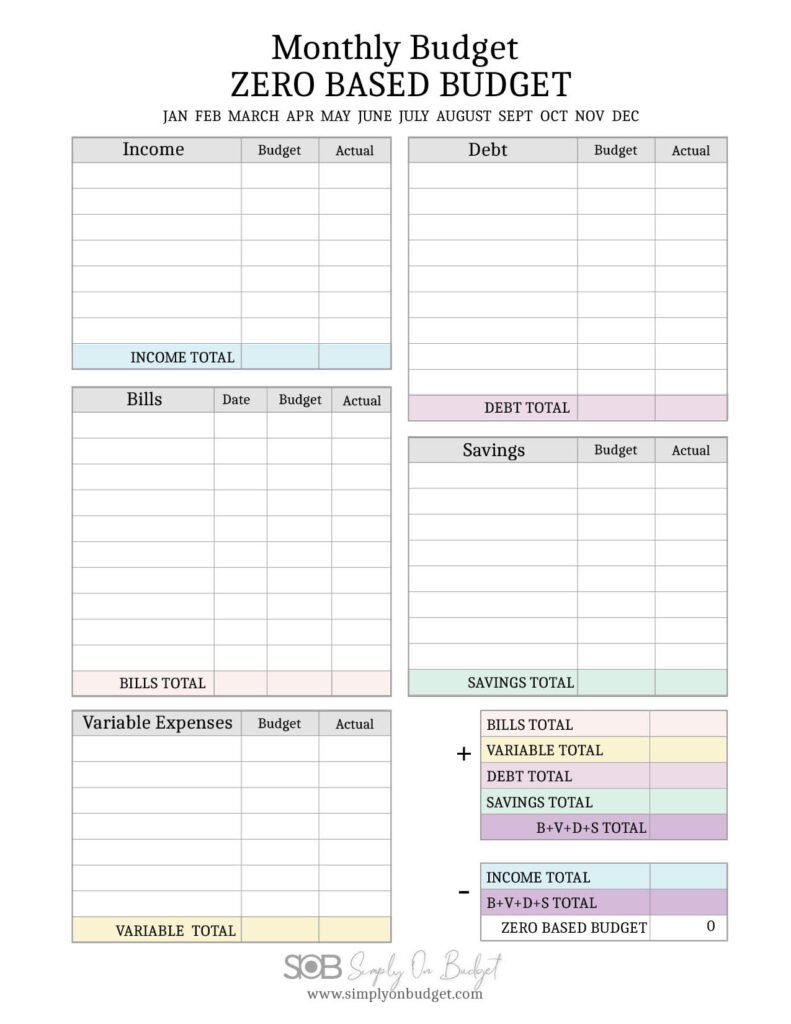

Ready to build your own zero-based budget? As promised, here is a free worksheet download. Here’s a friendly, fuss-free way to get it done:

1. Figure Out Your Total Income for the Month

Start by summing up all sources of money you expect to receive this month. That could be your regular salary, freelance earnings, child support, allowance, or anything else coming in. It’s best to use your net pay (the amount after taxes and deductions). If your income isn’t the same each month, look at your lowest recent month to be safe.

2. List Out All Your Expenses

Next, write down absolutely everything you need (or plan) to spend money on. Bring out your bank and credit card statements and take a good look at them. Don’t just focus on the obvious—remember annual bills, birthday gifts, or irregular expenses that sneak up on you. Pro Tip: Make a separate list of annual bills and irregular expenses that often catch you by surprise, total them, and divide that number by 12. You can now see how much you can budget for those and include that in your monthly budget.

It’s helpful to split your expenses into a couple of buckets:

Fixed Expenses: These are steady and predictable every month.

- Rent/mortgage

- Loan and debt payments

- Insurance premiums

- Internet and phone bills

- Subscriptions you use

Variable Expenses: These can go up or down, and they’re usually easier to adjust if needed.

- Бакалейные товары

- Gas or public transit

- Утилиты

- Развлечения

- Ужин

- Shopping/personal care

When in doubt, add it in—you want a complete picture.

3. Assign Every Dollar a Job

Now, go through your income and decide where every single dollar will go. Prioritize your basics (like housing, food, and bills) first. Next, budget for debt payments, savings, and any specific financial goals—don’t treat saving as an afterthought! Finally, use what’s left for discretionary categories like hobbies, eating out, or a fun night with friends.

Keep adjusting your numbers until the math works out:

Total Income – (Total Expenses + Savings + Debt Payments) = $0

If you wind up with a negative number, look for areas to cut. If there’s leftover money, assign it to a sinking fund, extra debt payments, or savings. No dollar gets left unexplained!

4. Keep an Eye on Your Spending

The most detailed budget is useless if you don’t track how it plays out in real life. You can use a notebook, spreadsheet, or one of the many budgeting apps that connect to your bank. The goal is to regularly update what you’re actually spending in each category so you spot problems early.

Some people prefer digital tools; others love the envelope method (where you keep actual cash in labeled envelopes for variable expenses). Whatever system helps you stick to your categories—use it!

When you overspend in one area, don’t stress. Just move money between categories to cover it, so you stay in control.

5. Reflect, Review, and Reset Each Month

At the end of the month, give your budget a quick review:

- Where did you go over? Where did you come in under?

- Was there anything you didn’t expect?

- Did you make headway on your savings or debt?

- Do you want to shuffle priorities next month?

Zero-based budgeting gets easier and more accurate with practice. Your first couple of months might feel clunky—just stick with it and adjust as you go. Each review is a chance to improve and get closer to your money goals.

Take Charge: Start Small and Keep Going

Zero-based budgeting isn’t just about numbers; it’s about making choices that shape your financial future, one month at a time. Every dollar gets a purpose, and that means your financial life starts to reflect your real values.

If the idea feels daunting, give yourself grace. Try it for just one month to see what you learn. Remember, you can use digital apps, paper, or whatever system you like best. Over time, you’ll feel more confident and empowered, and your savings (and peace of mind) will grow.

If you like the idea of using a spreadsheet for your finances, you can use our Budget By Paycheck spreadsheet, and assign the numbers in “Budgeted” so that your Total Expenses + Savings + Debt Payments are equal to the income you have coming in.